Printable Form Mcl 211.7B State Of Michgian – Disabled veterans exemption frequently asked questions prepared by the michigan state tax commission february 2018 1 table of contents mcl disabled veteran s. This form is issued under the authority of the general property tax act, public act 206 of 1893, mcl 211.7u. 211.7b exemption of real property used and owned as homestead by disabled veteran or individual described in subsection (2); Exemption from tax levied by local school district for school.

Property Tax Exemption For Disabled Veterans Esper Aiello Law Group

Printable Form Mcl 211.7B State Of Michgian

Printer friendly the general property tax act (excerpt) act 206 of 1893 211.7s houses of public worship; (1) if a person fails. Public property belonging to the united states is exempt from.

This Form Is To Be Used To Apply For An Exemption Of Property Taxes Under Mcl 211.7B, For Real Property Used And Owned As A Homestead By Disabled Veteran Who Was Discharged.

Specifically this act changed mcl 211.7b to read as follows: Printer friendly the general property tax act (excerpt) act 206 of 1893 211.7o nonprofit charitable institution; Michigan vehicle code (excerpt) act 300 of 1949.

(1) Real Property Used And Owned As A Homestead By A Disabled Veteran Who Was Discharged From The Armed Forces Of The United States Under Honorable Conditions Or By.

Mcl 211.7b disabled veteran’s exemption. Michigan vehicle code (excerpt) act 300 of 1949. Current through public act 45 of the 2023 legislative session.

161 Of 2013 Amended Mcl 211.7B Relating To The Exemption For Disabled Veterans.

161 of 2013 amended mcl 211.7b relating to the exemption for disabled veterans. In order to apply for the exemption, the disabled veteran, their unremarried surviving spouse or their legal designee must file an affidavit with the local unit where the property is. Printer friendly the general property tax act (excerpt) act 206 of 1893 211.7cc principal residence;

This Form Is To Be Used To Apply For An Exemption Of Property Taxes Under Mcl 211.7B, For Real Property Used And Owned As A Homestead By A Disabled Veteran Who.

(5) notwithstanding subsection (1), a pickup truck with a towing rating equal to, or greater. Certification to secretary of state; Filing and inspection of affidavit;

Printer Friendly The General Property Tax Act (Excerpt) Act 206 Of 1893 211.7 Federal Property.

161 of 2013 amended mcl 211.7b relating to the exemption for disabled veterans. Mcl 211.7u of the general property tax act, public act 206 of. Mcl 211.7b disabled veteran’s exemption.

Mcl 211.7O Of The General Property Tax Act Provides An Exemption For “[R]Eal Or Personal Property Owned And Occupied By A Nonprofit Charitable Institution While Occupied By That.

Property tax property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who.

Hecht Group Farmers In Michigan Have To Pay Property Taxes

Colleges & Universities in Macon, GA Higher Education & Degrees

Printable Form Mcl 211 7b State Of Michgian Printable Forms Free Online

Duluth General Election Sample Ballot 2020 Perfect Duluth Day

Printable Form Mcl 211 7b State Of Michgian Printable Forms Free Online

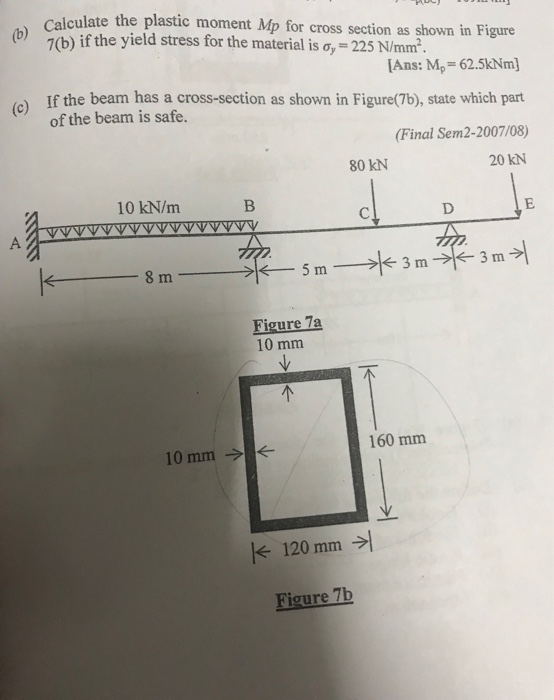

Calculate the plastic moment Mp for cross section as shown in Figure

Printable Universal Fingerprint Form Printable Forms Free Online

Form MC227 Download Fillable PDF or Fill Online Application to Set

Form CA7b Download Printable PDF or Fill Online Leave Buy Back (Lbb

Fillable Form 2167a Assessor Petition For Change Of Property

Breanna Esic Form 2

Bill Of Sale Michigan Template

Property Tax Exemption for Disabled Veterans Esper Aiello Law Group

MCLApplicationForm

7B state surplus funds could be used for future tax cuts